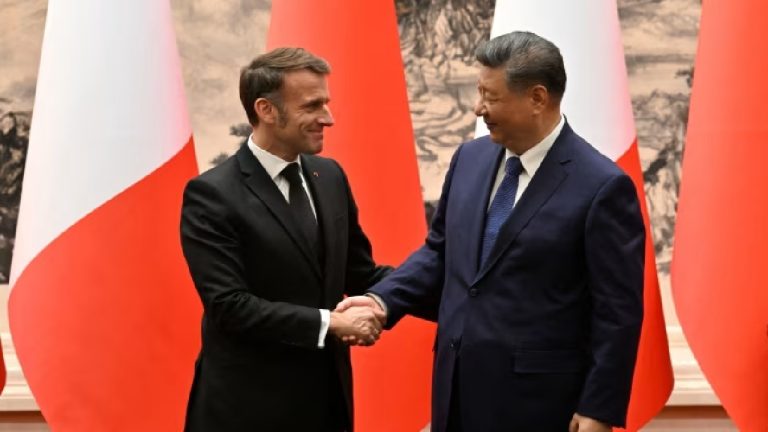

Emmanuel Macron’s December visit to Beijing represented a strategic pivot for France—attempting to transform deepening trade deficits into investment opportunities while simultaneously pressuring China on European security concerns. The mission exposed fundamental tensions in European-Chinese relations: Brussels demands economic rebalancing while Beijing seeks continued market access amid escalating transatlantic trade conflicts.

Trade Imbalance Reaches Crisis Proportions

European economic vulnerabilities drive French diplomatic urgency. The EU’s goods trade deficit with China reached €305.8 billion in 2024, declining slightly from 2023’s €297 billion but reflecting structural imbalances that have quadrupled in volume over the past decade. France specifically faces acute exposure—its bilateral deficit stands at approximately €47 billion, representing nearly half its total trade shortfall.

This asymmetry reflects technological transformation that European policymakers failed to anticipate. China’s trade surplus with the EU swelled to almost $143 billion in the first half of 2025 alone—a record for any six-month period. The acceleration suggests not temporary fluctuation but systemic reorientation as Chinese manufacturing climbs value chains previously dominated by European producers.

Macron characterized the challenge starkly upon returning to Paris, warning that China threatens “the heart of Europe’s industrial model”. This assessment acknowledges belatedly what industrial strategists have documented for years: Europe’s competitive advantage in high-technology manufacturing erodes as Chinese capabilities expand across sectors from automotive to renewable energy infrastructure.

The automotive sector crystallizes these dynamics. European manufacturers relocated production to China seeking cost advantages, only to face competition from Chinese brands like BYD capturing market share while American tariffs block Chinese-manufactured vehicles from that market. This leaves Europe absorbing production that cannot access other major economies—undermining both European manufacturers’ competitiveness and domestic industrial employment.

Tariff Threats Mask Investment Dependency

Macron’s approach combines rhetorical pressure with strategic accommodation. He warned that China’s growing trade surplus is becoming “unsustainable” while simultaneously courting Chinese investment to offset France’s economic vulnerabilities. This contradiction reflects uncomfortable reality: Europe lacks leverage for genuine confrontation.

Macron stated Europe needs “clearer framework” for Chinese direct investment, implicitly acknowledging that capital flows increasingly favor China rather than European outward investment. China’s FDI into the EU reached €9.4 billion in 2024, while European investment in China totaled only €10.1 billion—near parity marking dramatic reversal from decades when European capital dominated bilateral investment relationships.

The tariff discussion serves primarily signaling functions rather than serious policy preparation. Brussels previously imposed 20-50% duties on specific sectors including electric vehicles, green technology and industrial goods, yet these measures address symptoms without resolving fundamental competitiveness problems. Broader tariff implementation would likely provoke Chinese retaliation damaging European exporters while failing to restore industrial competitiveness.

Beijing understands these constraints. Tensions escalated when France backed EU tariffs on Chinese electric vehicles, prompting Beijing to impose minimum price requirements on French cognac—calculated response targeting politically sensitive agricultural interests. French pork and dairy producers fear similar treatment, constraining Paris’s willingness to pursue aggressive trade measures despite economic rationale.

Macron’s strategy emphasizes attracting Chinese manufacturing investment to Europe rather than excluding Chinese products. This represents adaptation to realities European policymakers previously denied: if Europe cannot compete with Chinese production costs and increasingly cannot match technological sophistication, alternative approaches require integrating Chinese capital and capabilities within European territory.

Ukraine Diplomacy Encounters Beijing’s Strategic Priorities

Beyond commercial negotiations, Macron pursued security cooperation—specifically Chinese pressure on Russia regarding Ukraine. The French president urged Xi to “help end the war in Ukraine” and convinced Beijing to “refrain from providing Russia with any means whatsoever to continue the war.” These appeals acknowledge Western inability to compel Russian strategic recalculation without Beijing’s cooperation.

China has provided strong diplomatic support to Russia since its 2022 invasion while extending economic lifelines through increased trade. Western governments accuse Beijing of supplying military components for Russian defense industries—charges China denies while maintaining its partnership faces “no limits.” This positioning enables Beijing to benefit from European desperation for mediation while avoiding commitments that would constrain Russian operations.

Xi responded with formulaic assurances. The Chinese president stated China would “continue to play a constructive role in resolving the conflict” while supporting “balanced, effective, and sustainable security framework” in Europe. Such language commits Beijing to nothing specific while appearing diplomatically engaged—precisely the response that maximizes Chinese leverage without requiring difficult choices between Russian partnership and European commercial interests.

The strategic calculus remains transparent: China values Russian cooperation more than European diplomatic approval. Moscow provides energy resources, strategic alignment against American hegemony, and geopolitical partnership across Central Asia. European markets matter commercially but not enough to sacrifice Sino-Russian coordination, particularly when Trump administration peace proposals effectively exclude European input.

Macron’s Ukraine diplomacy therefore functions primarily as positioning for domestic European audiences rather than realistic expectation of Chinese policy shifts. By publicly appealing to Beijing, Paris demonstrates exhausting diplomatic options while recognizing these appeals will produce minimal tangible results.

Taiwan Sensitivity Dominates Bilateral Agenda

Beijing’s priorities emerged clearly throughout discussions. Without naming Taiwan explicitly, China stated Macron agreed to the “one China policy”—diplomatic formulation indicating Taiwan as part of China. French government readouts avoided mentioning Taiwan, suggesting this issue dominated private discussions more extensively than public statements acknowledged.

The timing carried significance. China recently entered diplomatic disputes with Japan over Prime Minister Sanae Takaichi’s statement suggesting Japanese military response to potential Chinese invasion of Taiwan. Beijing seeks European reaffirmation of its territorial claims precisely when regional tensions escalate and American security commitments face uncertainty under Trump administration policies.

For France, accommodating Chinese sensitivities on Taiwan costs little immediately while potentially yielding commercial advantages. European nations lack direct security commitments to Taiwan and possess limited capacity for military involvement in East Asian contingencies. Reaffirming “one China policy” therefore represents diplomatic currency France can spend without substantive policy changes—trading rhetorical support for economic access.

This transactional approach reveals European strategic limitations. Unable to substantially influence either Chinese domestic policy or regional security dynamics, European powers offer symbolic affirmations in exchange for commercial considerations. Such bargains work only while China values European markets sufficiently to reward diplomatic alignment—a calculation that could shift as Chinese domestic consumption grows or alternative markets expand.

Defense Spending Escalation Strains Fiscal Capacity

European security anxieties intensify economic pressures driving Macron’s China outreach. EU member states’ defense expenditure reached €343 billion in 2024, projected to climb to €381 billion in 2025—an 11% increase. The European Commission’s ReArm Europe plan aims to leverage €800 billion in defense spending through 2029, including €150 billion in EU-backed loans and measures encouraging national spending increases.

Germany’s parliament approved exempting defense spending beyond 1% of GDP from debt limits, enabling a €500 billion fund for defense and infrastructure. These commitments reflect recognition that European conventional capabilities deteriorated severely during decades of underinvestment. If EU states had maintained 2% GDP defense spending from 2006-2020, it would have generated €1.1 trillion additional expenditure—more than annual American defense budgets.

This militarization strains fiscal resources precisely when trade deficits and industrial decline squeeze government revenues. France confronts prolonged low growth, rising public debt and deepening budget deficits—conditions making massive defense increases politically difficult and economically destabilizing. Macron’s China visit therefore served dual purposes: securing investment to offset domestic economic weakness while managing European security architecture increasingly independent of reliable American support.

The contradiction becomes apparent: European nations cannot simultaneously impose aggressive tariffs damaging trading partners’ economies while demanding those same partners increase defense spending. Macron warned that China must “consume more and export less” while also seeking Chinese investment and market access—incompatible demands reflecting European strategic confusion rather than coherent policy.

Symbolic Agreements Obscure Substantive Gaps

Macron and Xi signed 12 agreements covering nuclear energy, education and panda conservation—primarily symbolic gestures lacking major commercial content. No substantial business deals emerged from a ceremony attended by executives from Airbus, BNP Paribas, Schneider and Alstom, among others traveling with France’s presidential delegation.

Most notably absent: anticipated Airbus orders. The expected 500-jet purchase remained unsigned, as Beijing preserves this leverage for trade negotiations with Washington requiring Boeing purchase commitments. This calculation demonstrates European secondary status in Chinese strategic priorities—commercial relationships subordinated to managing American pressure.

The ceremonial nature of agreements highlighted diplomatic limitations. Xi called for making bilateral relations “more stable” while mentioning need to “exclude any interference”—language suggesting Chinese concerns about American influence on European China policy. Macron responded by emphasizing capacity to “overcome differences for greater good” while making direct references to Ukraine.

These exchanges reveal fundamental asymmetry: France needs tangible economic results while China requires primarily rhetorical assurances and continued market access. Beijing can afford patience knowing European economic vulnerabilities will intensify pressure for accommodation regardless of security concerns or human rights considerations.

Strategic Autonomy Rhetoric Meets Dependency Reality

Macron’s China engagement ostensibly advances his longstanding advocacy for European “strategic autonomy”—continental capacity to pursue independent foreign and defense policy without excessive American or Chinese dependence. Reality contradicts aspiration. Europe increasingly relies on American liquefied natural gas following Russian supply disruptions, while simultaneously growing dependent on Chinese renewable energy components, manufactured goods and potentially investment capital.

The visit’s timing—immediately following Trump’s return to Washington and amid American disengagement threats from European security—underscored these dependencies. European powers cannot compel Russian behavior change, cannot match Chinese industrial capacity, and cannot ensure continued American security guarantees. Macron stated “world risks disintegration of the international order that brought peace for decades” while acknowledging limited European capacity to prevent such disintegration.

Strategic autonomy requires economic foundations Europe no longer possesses. European supply chains support components ending up in vehicles exported predominantly from Germany, yet this integration created vulnerabilities as Chinese competition displaced European production. Europe’s quick shift to renewable energy left the continent dependent on Chinese wind and solar components—exchanging Russian fossil fuel dependence for Chinese green technology dependence.

Macron’s approach acknowledges these realities without resolving them. Courting Chinese investment represents accepting subordinate position within global production networks rather than rebuilding independent capabilities. This pragmatism may prove economically rational but undermines strategic autonomy rhetoric—Europe becomes prize contested between American and Chinese spheres rather than independent pole within multipolar order.

Conclusion: Accommodation Masquerading as Strategy

Macron’s Beijing visit produced minimal concrete outcomes beyond symbolic agreements and vague commitments. The most likely near-term result remains new tariffs on Chinese goods—exactly opposite the economic integration Macron ostensibly pursued. This reflects European strategic incoherence: unable to compete, unwilling to fully accommodate, lacking leverage for genuine pressure.

The fundamental contradiction persists: European nations want China to reduce exports while increasing Chinese investment, want Beijing to pressure Russia while maintaining Chinese market access, want strategic autonomy while depending on external capital and technology. These incompatible objectives reflect not careful strategy but improvisation masking structural decline.

France and broader Europe confront uncomfortable reality that previous models no longer function. The era when Europe exported high technology while importing cheap goods ended as Chinese capabilities climbed value chains. The period when European capital dominated global investment flows reversed as Chinese resources now seek European opportunities. The assumption that European moral authority and institutional legitimacy provided leverage dissipated as non-Western powers developed alternative frameworks.

Macron’s message that China must help stop Russia “if you want to trade with Europe” represents fantasy rather than realistic diplomacy. Beijing possesses alternatives while Europe lacks substitutes for Chinese production capacity, investment capital and manufacturing capabilities. The trade war proceeds separately from American-Chinese conflicts rather than coordinated response because Europe cannot afford genuine confrontation.

What emerges is not strategic recalibration but managed decline—attempting to extract maximum concessions during negotiated accommodation to Chinese economic preeminence. Whether this approach preserves sufficient European industrial capacity and political autonomy remains doubtful. For now, Paris pursues investment diplomacy because alternatives either failed or prove economically unviable—hardly inspiring foundation for continental revival, but perhaps realistic assessment of available options.

Original analysis inspired by Dr. Nevzet Celik from Anadolu Agency. Additional research and verification conducted through multiple sources.