Budget Law Adopts Modified Version of Flawed Tax on Remittances

The recently passed 1% tax on cash-based remittances, while improved from earlier proposals, remains a flawed policy. Though it avoids privacy concerns by eliminating reporting requirements, critics argue it serves no clear economic purpose and may inadvertently strain migrant-sending economies. With exemptions for digital payments, the measure’s narrow scope raises questions about its effectiveness as a revenue tool.

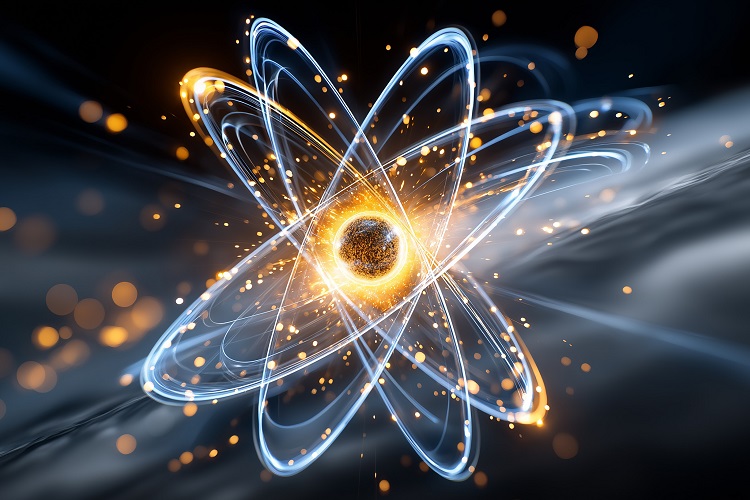

Trump’s Discordant Innovation Agenda: Deregulation Without Discovery

The Trump administration’s push to modernize nuclear energy regulations marks a potential turning point for America’s clean energy future—but at what cost? This analysis examines the administration’s controversial plan to overhaul radiation safety standards while dramatically cutting scientific research funding. We assess whether this approach will accelerate advanced reactor deployment or inadvertently sacrifice long-term innovation leadership to global competitors like China.

Five Questions: Peter Hussey on How to Fix American Health Care

The United States is projected to spend more than $5 trillion this year on health care. Yet by most measures, the system performs worse than those in other wealthy nations. Peter Hussey, vice president and director of RAND Health Care, discusses ways to improve it.The United States is projected to spend more than $5 trillion this year on health care. Yet by most measures, the system performs worse than those in other wealthy nations. Peter Hussey, vice president and director of RAND Health Care, discusses ways to improve it.

Countering Russian Influence: Support for Armenia, Georgia, and Moldova in the ‘Waiting Room of the West’

As Europe supports Ukraine, three other post-Soviet states remain dangerously exposed to Russian coercion and aggression. Russian efforts to destabilize these states are already underway, raising a significant challenge for European decisionmakers.

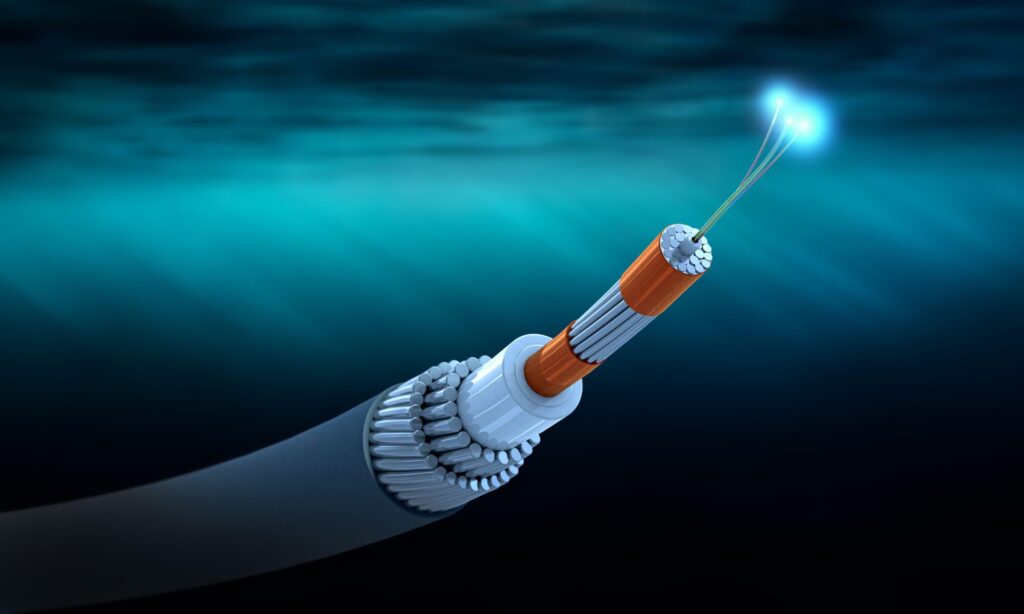

Undersea Cables Are Vulnerable to Sabotage—but This Takes Skill and Specialist Equipment

Countries have come to rely on a network of cables and pipes under the sea for their energy and communications. A coordinated attack on this network could have devastating consequences. But that is difficult business in a very challenging environment.

Golden Dome Could Learn from SDI Politics

Trump’s Golden Dome missile defense initiative should learn from the strategic miscalculations of Reagan’s SDI program.